Bitcoin as Digital Cash

Bitcoin is like real cash, but formless and with a fixed supply. Its adopters immunize themselves against fiat inflation and gain privacy advantages.

Bitcoin is like real cash, but formless (purely electronic) and with a fixed supply of 21 million. Sovereign individuals can increase their privacy and protect their wealth by adopting bitcoin, even on the margin.

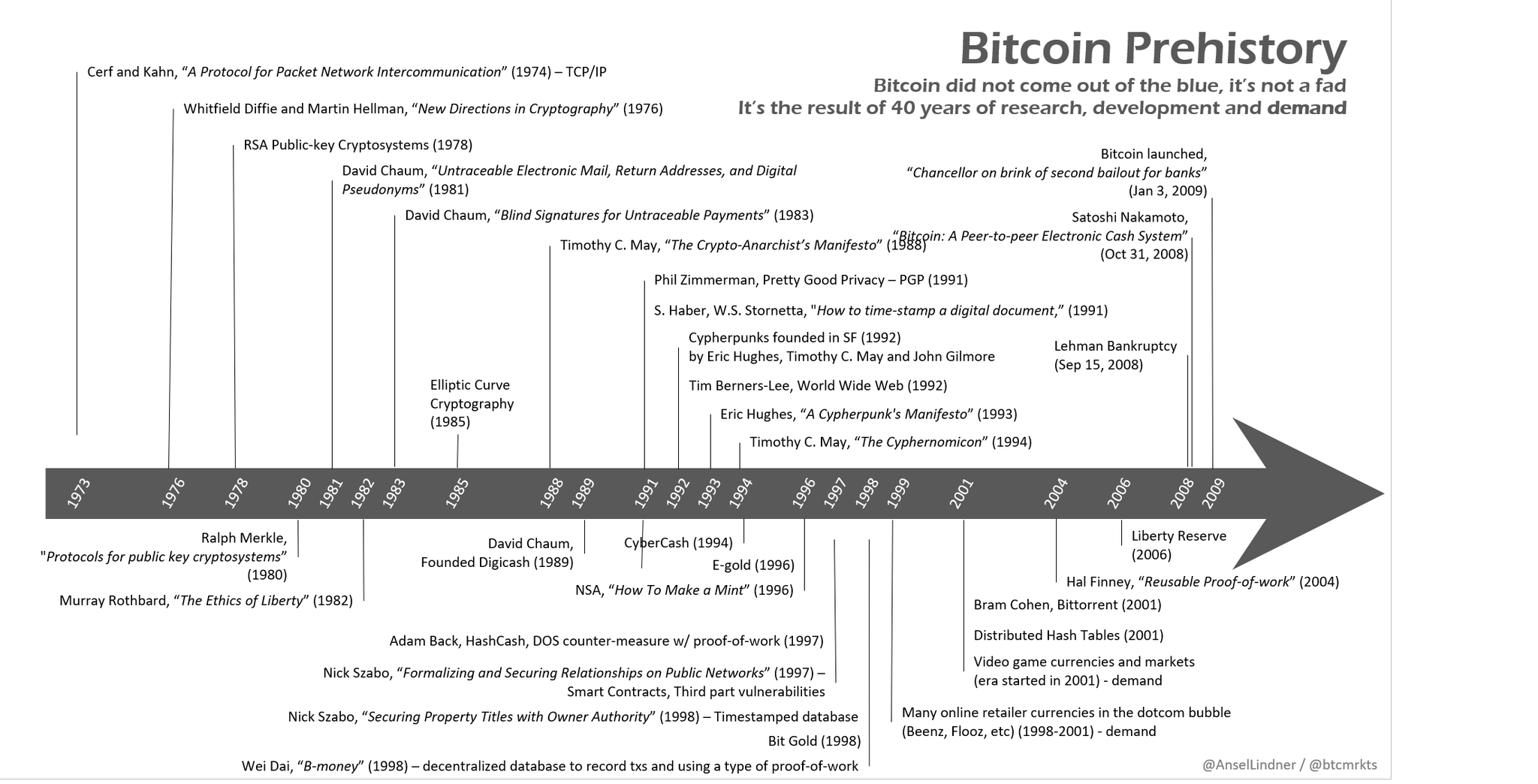

Bitcoin Prehistory

Until the announcement of the Bitcoin Whitepaper by Satoshi Nakamoto on October 31, 2008, the idea of a workable digital currency without counterparty risk was difficult to envision.

Many very smart people made attempts over the years to lay the groundwork or build something like it, but bitcoin was the first truly peer-to-peer digital cash system that was robust against attacks and built in reasonable incentives for participants to help grow the network.

The fact that it works, and the manner in which is works, has been proven out over 14+ years now. The proof is in the pudding, so to speak.

For those that want to understand how it works, I recommend reading the bitcoin whitepaper (semi-technical, only 8 pages long): https://nakamotoinstitute.org/bitcoin/

But just as the internet works, or a car runs, without their every user (driver) grokking every minutiae, bitcoin plods on, settling billions of dollars a day of transactions.

A BitTorrent of Money

The truth is there now exists a BitTorrent of Money. For those not familiar, BitTorrent is a peer-to-peer file transfer protocol that is immune to censorship. Using BitTorrent software it is possible to download/upload any number of files, media, etc. without middlemen and with nobody to stop you.

Bitcoin works in the same fashion. It is transferred peer to peer between individuals. The current balance in everyone's "account" (wallet) is tracked globally in a distributed ledger and updated every 10 minutes. And every user can verify for themselves that transactions are legitimate and they control X amount of monetary value on the network simply and easily using their "wallet software".

A "wallet" is really just an app that lets you receive coins, spend coins and track your balance. Under the hood it is a system that keeps safe your private keys, which ultimately are used to sign off on transactions.

Perhaps with Zelle, Venmo, PayPal, etc. (consumer spending apps), these concepts are no longer so foreign. But I imagine less technically inclined (read: older generations) still might struggle to get the concept.

Importantly, PayPal and the like control who you can send money to, and they rely on various intermediaries all the way down to the Federal Reserve/Central Bank, which constantly mess with the money supply. So many trusted third parties in the mix.

With bitcoin, there is just you and the person you wish to transact with, be it a business or a charity or an individual.

Fixed Supply

One of the other main advantages of this monetary network is in its fixed supply of 21 million bitcoin. The number itself could be different, but the fact that it's fixed is what really matters. Every participant in the network agrees to and enforces this supply cap, meaning users of bitcoin can never be debased. No monetary inflation. Period.

Pseudo-Anonymity

Finally, bitcoin is pseudonymous. Meaning you can spend and receive it without authenticating yourself or identifying yourself to any third parties (whether these be nation states, corporations, or even the person you're transacting with).

The Ledger Is Public

The fact that the bitcoin ledger is public means certain metadata about your transactions and the past history of any coins you hold may be known or easily derived. But tools exist to enhance the privacy of bitcoin over this 'public' baseline too: Namely, coinjoin. (Click here to read more about using coinjoin for privacy on bitcoin.)

With that said, even the baseline pseudonymity of bitcoin provides for better privacy than PayPal, your Credit Card, or a paper check.

More and more merchants accept bitcoin. And there exists the possibility to quickly swap in and out of bitcoin just to make payments (e.g. via Strike, Cash App). You don't even have to hold bitcoin yourself in order to make a payment with it, in effect.

Advantages Accrue to Adopters

So the main advantages of bitcoin that accrue to its adopters can be summarized as:

- Fixed money supply means you can't be debased

- Electronic, peer-to-peer payments mean you can't be censored

- Pseudonymity and privacy tools help you reveal less about yourself when you transact

Adopting on the Margin

- What if you just made 5% of your payments using bitcoin?

- What if you held just 5% of your savings in bitcoin?

I would argue that either of these marginal changes would lead to vast improvements in individual sovereignty.

In a world where governments are working as quickly as possible to vanquish physical cash, and corporates track everything from your eyeballs to your gait, it pays to have and be able to use an alternative, more private monetary network.

In a world in which civil asset forfeiture, trade sanctions and baseless account closures (Looking at you PayPal) are increasingly normalized, you need a censorship resistant store of wealth.

You don't have to put all your money into bitcoin.

You don't have to spend bitcoin at every shop and stop using cash and cards all together.

But bitcoin is a parallel system. A voluntary system. And it is ready and waiting for you to dive in.