Bitcoin Rebase

If you think about it, it kinda sucks how this non-elected body of bureaucrats (the IRS) can declare bitcoin to be property and charge you for every time you spend it. To the tune of 15% for most investors (on any profits you've made).

2021 long-term capital gains tax rates: https://www.fool.com/research/capital-gains-tax-rates/

RATE–INCOME LEVEL- 0% – Up to $40,400

- 15% – Between $40,401 and $445,850

- 20% – Over $445,850

On the other hand, the fact that profits from your gains are not treated as income, whereas coins mined are treated as income, is advantageous to the average HODLer.

Sure, it's shitty to track it all and keep track of it all to file your taxes, but there are ways to make it easier on yourself, both monetarily and in terms of the time spent on all the FIFO-type calculations...

The first rule of bitcoin is Don't Sell Bitcoin.

The second rule of bitcoin is Don't Sell Bitcoin.

The third rule of bitcoin is...

But people will sell bitcoin, is the point. (Just like people will talk about Fight Club.)

So if you're going to sell, pay down some debt, do something fun, whatever your situation, there are some rules of thumb that will make life easier, both immediately afterwards, and also during the following April (Tax Season in the US).

Rules of Thumb for Selling Bitcoin

- Don't sell it all. (Trust me)

- Sell in amounts larger than $500 and less than $10,000. This is a heuristic that says: A) you've stacked some serious sats and earned some decent profits, but B) you also don't want the bank to question your deposit of $10,000+ USD.

- As soon as you've sold, record the sale, including the date and time, the general item description or vendor, and the amounts and prices. E.g. "SOLD

0.00870000 BTCin exchange forPRODUCT Xat a fiat cost of$504.60 USDonMay 10, 2021while price was$58,000 BTC/USD." Having all your purchases/sales written down or saved in one location come tax time will make your life much easier. Report each sale as something generic: e.g. "Bitcoin Long-Term Sale #1". NOTE: You will need to calculate your cost basis for the0.00870000 BTCon your own. Ideally, you would have kept records of all the times you bought bitcoin, how much, and at what price. If not, hopefully your exchange or whatnot can tell you (i.e. generate and send you a report). - Don't sell too much or too often. If you keep your sales/exchanges of BTC for other goods down to less than 20 per year, that's that many fewer FIFO-type cost basis calculations you'll have to do the next tax season. This is the other reason for rule #2: Less time spent doing your taxes. Imagine how you might consolidate some sales by doing some budget forecasting. Ask yourself: What big expenses might I have coming up over the next few months to one year? And how much cash money/cuck bucks will I need to cover those expenses? Not selling too much is helpful in that you can avoid accidentally pushing yourself up into the next tax bracket, for example.

Having taken care of some housekeeping in this fashion, you can now consider another strategy to minimize or at least even out the yearly tax burden, and spread it across multiple years (or decades as it were).

Rebasing Your Bitcoin

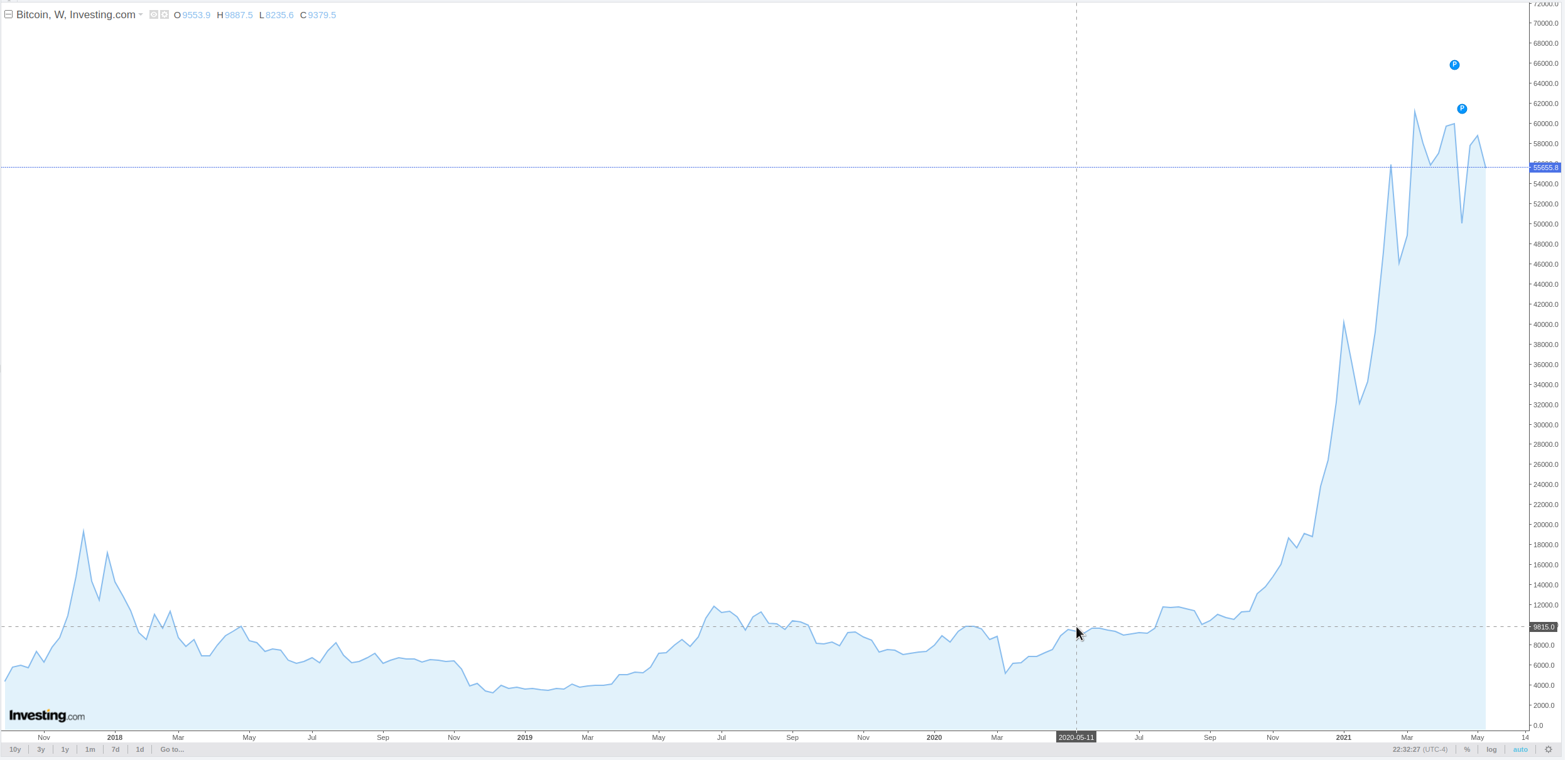

Think about it: Let's say you bought bitcoin one year ago at $9800. You bought 3 bitcoin (you lucky dog!).

Now you decide you want to sell some during 2021 after holding it for one year in order to finance a home purchase (down payment).

House prices are skyrocketing too, of course. So you settle for a house costing $400,000 as none cheaper than this exist anywhere near you where running water and electricity are also available. ;-) ... You choose to do a 20% down-payment, and put in $80,000. You already had $22,000 saved up, so you can sell one bitcoin at this point (#58K_GANG) to meet your goal.

In the above scenario, assuming a 15% long-term capital gains tax rate, you'll owe $7,230 next year on your $48,200 of profits. (Sucks, but at least you'll have a house!)

Now you have 2 bitcoin remaining that you've purchased at an average price of $9800.

Think to the future at this point. If bitcoin goes up just 55% per year, you would have the equivalent of $1,037,800 cuck bucks in five years time. Or $2,493,330 seven years from now.

One strategy to even out future tax burdens is to "rebase" a little bit each year.

Follow the guidelines laid out above regarding when and how much to sell, pay the taxes on those percentages of your portfolio that you've sold off. And, if you want, you can spend the cash on other things.

... Or you can just reinvest it in bitcoin, putting aside some cash for taxes the next year.

Imagine in the above scenario (2 BTC), that you choose to sell just 0.1 BTC each year for the next 5 years.

- 2022: Sell

0.1 BTCat89,900 BTC/USD=$8,990proceeds, pay$1201in taxes, reinvest the rest to buy back0.08664071 BTC - 2023: Sell

0.1 BTCat$139,345 BTC/USD=$13,935proceeds, pay$1943in taxes, reinvest the rest to buy back0.08605978 BTC - 2024: Sell

0.1 BTCat$215,985 BTC/USD=$21,599proceeds, pay$3093in taxes, reinvest the rest to buy back0.08568188 BTC - 2025: Sell

0.1 BTCat$334,776 BTC/USD=$33,478proceeds, pay$4875in taxes, reinvest the rest to buy back0.08543922 BTC - 2026: Sell

0.1 BTCat$518,903 BTC/USD=$51,890proceeds, pay$7637in taxes, reinvest the rest to buy back0.08528184 BTC

Total BTC after 5 years = 1.92910343 BTC worth $1,001,018 USD

Total spent on taxes = $18,749

New average price/coin: $125,843 for 1.92910343 BTC = $65,233/coin

In this manner, you've raised your total average cost basis from $9800 to $65,233, an increase of 6-7x.

Now, in theory, if you were to go and cash out completely (never cash out completely), your tax burden would be lessened significantly:

Without rebasing – selling at $518,903 BTC/USD:

- Sell

2.0 BTCfor$1,037,806 USD - Cost basis:

$19,600 - Net proceeds:

$1,018,206(20% LTCG tax rate) - Tax bill:

$203,641 - Total remaining after taxes:

$814,565

With rebasing:

- Sell

1.92910343 BTCfor$1,001,018 USD - Cost basis:

$125,841 - Net proceeds:

$875,177(20% LTCG tax rate) - Tax bill:

$175,035 - Total remaining after taxes:

$825,983

So with rebasing, you spent $193,784 USD in total on taxes in this scenario. Without rebasing, you spent $203,641, or 5% more.

What you have remaining after rebasing ($825,983) is 1.4% higher than the amount you'd have otherwise ($814,565).

Do you really want to give 5% more in tax revenue to the government at any point?

Is it worth saving even 1.4% more money in the long run for all the trouble in the meantime?

1.4% may not sound like a lot. But $11,418 saved through this process over 5 years sounds great to me.

Some food for thought.