Buying Gold

[Really not financial advice.]

Most of what you'll see me advocating online, whether here or on Twitter is to buy bitcoin, not gold.

So why am I talking about how to buy gold?

Well, first off, not everyone has come around to the idea of a Perfectly Scarce, Digital Veblen Good approaching Infinite Stock-to-Flow...

And perhaps not everyone will. Which I think, is just fine, as long as there are other real and accessible means to fight the rampant dilution of the money supply and money printer go BRRRR phenomena.

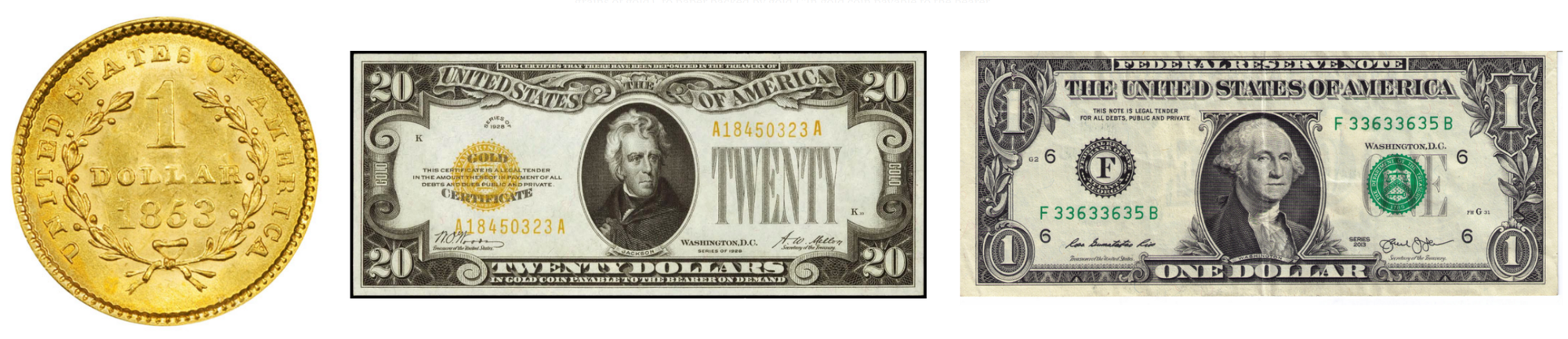

Gold and Silver are two totally legitimate means by which to do this, and have been for millennia. The existence of Bitcoin as an alternative monetary network which ferries around a new and more finite digital gold doesn't necessarily obviate or immediately render valueless the above-mentioned precious metals.

Despite silver's precocious and volatile returns it has more or less kept pace with inflation over the last 45 years, assuming a 3% average CPI number. Gold has done doubly well in comparison, with reduced volatility, however. So it's not surprising that it has such strong network effects.

But if you actually want to buy some physical gold bullion, you may be in for a world of hurt. Premiums on fractional (i.e. less than one troy ounce) bullion gold coins tend to range from 10% to 30%.

Can you imagine buying a house for a 30% premium and selling it a year later for a 30% discount. <– This is often the case for smalltime buyers of gold. They buy at a huge premium (worse for credit card users) and sell at a huge discount at the coin shop when they bring it in to get some cash.

Various subscription and online vaulting services have popped up over the years. Many now cater to the new Millenial Money. But few make it clear what premiums you're paying, or how you can "cash out" if you ever need to.

A friend recently asked me to review one such service because he's interested in buying some gold.

This company offered to hold onto your money until you had saved up enough for one of their Stamped-Numbered-and-Sealed gold bars, at which point they'd ship it to you.

What wasn't clear was the premium you pay over spot. And since it's a newer company, it's really not clear how much you could sell one of these bars for at a local coin shop (the secondary market).

Absent these two key pieces of information, I offered the following alternative suggestions to this buddy of mine:

- Save up your money yourself until you can buy a 1/10th troy ounce gold coin, or a similar sized bar, from one of the major world mints.

- Buy $PHYS, the Sprott Physical Gold Bullion Trust, for a 0% premium, as a simple means of getting gold exposure.

If he wanted to go with option #1, I pointed him to a number of reputable firms that I've used in the past, as places from which to buy or where he could do some comparison shopping.

These included:

- Provident Metals or JM Bullion (the former a subsidiary of the latter) -- good selection, competitive premiums

- Apmex -- best overall selection, especially of rare coins

- Silver Gold Bull -- best filtering tool ("Filter by price per troy ounce")

- Gainesville Coins -- good selection, competitive premiums

NOTE: I am not paid by any of these companies to promote their products and services. I can vouch for all of them as a customer, however.

The other option, less advisable to newbies, in my opinion, is to visit a local coin shop with cash in hand.

If you do visit a local coin shop for the first time, I recommend asking to see a list of their most popular gold coins and bars, and the prices at which they are trading today, if such information is not clearly posted for everyone to see.

The next question is to ask about the lowest premium gold coins and bars on offer. If the shopkeeper refuses or hesitates in divulging this information, walk out and find another coin shop. A coin shop should want repeat customers, which doesn't often materialize if transparency is not evident, or if people feel swindled when they get home and realize they overpaid for something.

The second option, PHYS, the gold bullion trust, is easy if you have a brokerage account. The fees per year are modest and the premiums are null. But for folks that want real physical hard money in their hands, gold and silver bullion are hard to beat (I'd argue only bitcoin beats them).