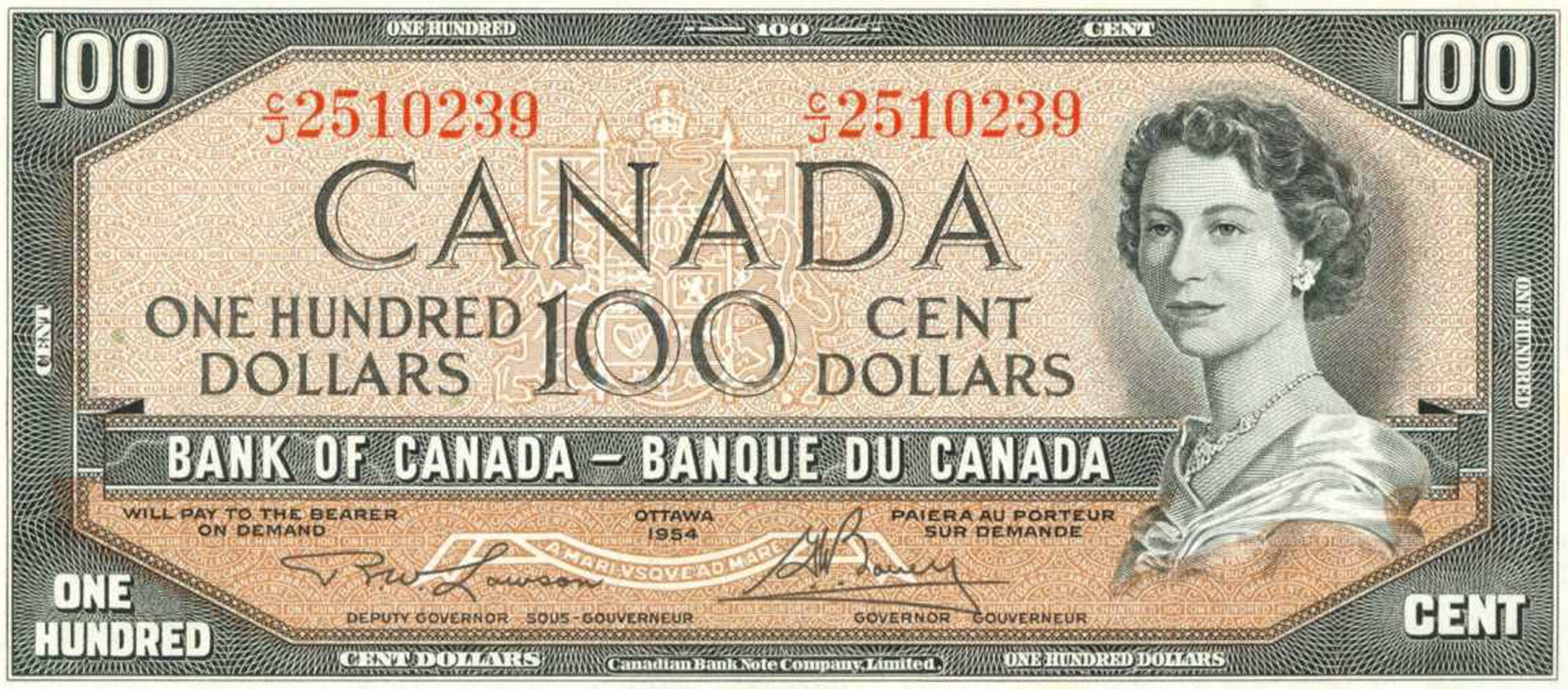

Fancy Fiat

Let me tell you about these fancy promises they call legal tender.

Every 5-7 years on average, one of these relatively "stable" fiat currencies lose 10% or more of their purchasing power.

This happens either through debasement (money supply increases) or devaluation (hard resets of the purchasing power of a currency).

For G10 fiat holders, there's a 15-20% chance of losing purchasing power like this in a given year.

Whether the central banks pin the blame on wars, plagues, embargoes, black mondays, tariffs, unforeseen banking system issues, or evergiven canal-blocking vessels doesn't matter.

The fact is that these episodes are all too common.

The M2 money supply in the US, for instance, has grown 7% compounded over the last 5 years.

That's equal to a 40% reduction in the purchasing power of the dollar, roughly speaking. (And while it's not overnight in this case, it is undeniable.)

CPI (CP-Lie) Economists will tell you that you're missing GDP and the efficiencies built into newer/better/faster/stronger products (i.e. 1984 Surveillance Television Sets).

But you know if you go to the store your bill is MUCH higher than 5 years ago for basic necessities. You know this.

Fiat currencies bleed value.

Sound monies don't.

Sadly any uninvested money is at risk.

This is not to say you shouldn't keep some cash around and use it. You should.

But if you don't care to gamble on the undying multiple expansion of your favorite large cap growth stocks (MAG7), then consider stashing some sats or some coins in a hat (or a safe to be safe).

Source: All the books they don't tell you to read in school.

Things to Keep: MCBAGS: Monero-Cash-Bitcoin-Ammo-Gold-Silver