Helter Skelter

AI;DR: (AI; Didn't Read) -- Sometimes life surprises you and a week feels like a decade. This is true in markets and in real life too.

The content below was written 95% by ChatGPT 5.2 Thinking.

ORIGINAL PROMPT: Discuss real life examples of Heteroskedasticity as observed in markets, episodes of "High Vol-of-Vol" and how various asset classes performed during those periods. End with application to other areas of life, considering Lenin's famous line "There are decades where nothing happens and weeks where decades happen."

INSPIRED BY: "Volatility is not constant over a year" concept from "Nvidia Stock Crash Prediction": entropicthoughts.com/nvidia-stock-crash-prediction

Heteroskedasticity is the statistical name for a simple market truth: The size of tomorrow’s move depends on what today feels like. In calm regimes, returns arrive in small, fairly even increments; in stressed regimes, the distribution “breathes,” with fat tails, bigger gaps, and volatility that clusters. Markets are not merely noisy – they are unevenly noisy, and the variance itself behaves like a state variable.

Real-life Examples of Heteroskedasticity in Markets

The most familiar example is equities. Daily stock-index returns are not independent draws from a fixed-variance process; they arrive in bursts. After a surprise macro print, a policy shock, or a liquidity event, large moves tend to be followed by large moves (of either sign), while tranquil periods can persist for weeks. This is heteroskedasticity as lived experience: “Quiet” days are informative because they often beget more quiet, and “loud” days rarely come alone.

FX shows the same pattern, but often around discrete catalysts: Central-bank decisions, pegs breaking, elections, or sudden terms-of-trade shifts. A currency can trade in a narrow band for months, then reprice violently in a few sessions – variance that is conditional on regime.

Rates markets are a particularly clean laboratory. When inflation expectations are anchored and central-bank reaction functions are well understood, yields drift with modest day-to-day changes; when the path of policy becomes uncertain (or the term premium is reawakened), realized volatility jumps and stays elevated. Credit spreads are similarly heteroskedastic: Tight spreads and low dispersion can persist, but once defaults, downgrades, or funding stress re-enter the conversation, spread volatility and correlation across issuers rise sharply.

“High Vol-of-Vol” Episodes: When Uncertainty about Uncertainty Spikes

Volatility itself is tradable (options), so markets also reveal a second layer: Volatility of volatility – how unstable implied volatility is from day to day. Traders often proxy this in equities with the VIX (level of implied vol) and measures like VVIX (vol-of-vol). “High vol-of-vol” tends to appear when investors cannot even agree on the distribution of outcomes – only that it is unstable – so option prices and skews reprice repeatedly.

2008–2009: Deleveraging and balance-sheet stress

The Great Financial Crisis was a canonical high-vol-of-vol regime. Equity volatility stayed high and whipped around as policy interventions alternated between reassurance and fresh concern. Cross-asset correlations surged: Diversification benefits that looked reliable in backtests weakened right when they were most needed.

Typical performance pattern: Equities and credit sold off hard; high-yield underperformed investment-grade; funding-sensitive strategies (levered carry, relative value) struggled; high-quality government bonds often rallied as a safe haven and as expectations of growth collapsed; the dollar tended to strengthen in global stress (via funding demand), while commodities generally weakened with growth fears.

August 2011 and other “policy credibility” scares

When the market’s question is “Who is in control? Politicians, central banks or the tape?”, implied vol can jump and then reprice repeatedly as headlines arrive. Here, vol-of-vol isn’t just about bad outcomes; it’s about shifting narratives and discontinuous probability updates.

In August 2011, markets were rocked by the U.S. debt-ceiling standoff (all-too familiar at this point, no?) and the August 5, 2011 S&P downgrade of U.S. sovereign credit, alongside escalating Eurozone sovereign-debt fears, which together triggered a sharp global equity selloff and a surge in volatility. Despite the downgrade, investors largely fled into U.S. Treasuries and other “safe” assets as risk appetite collapsed.

Typical performance pattern: Risk assets wobble; defensives outperform cyclicals; quality and liquidity command a premium; government bonds and reserve currencies often benefit, though the exact winners depend on who is perceived as the credible safe haven.

February 2018: Volatility products and mechanical feedback

A more technical episode: Volatility rose and then volatility of volatility rose as systematic strategies and short-vol structures were forced to adjust. The key feature wasn’t only fundamentals but market microstructure – positioning, convexity, and gamma effects.

Typical performance pattern: Sharp equity drawdown in a short window; implied vol spikes; strategies short convexity (short options, certain risk-parity implementations under stress) face abrupt losses; high-quality bonds can help if the shock is not simultaneously inflationary.

March 2020: “Everything all at once,” plus liquidity fractures

This was a high-vol-of-vol moment where both fundamentals (pandemic uncertainty) and plumbing (liquidity, margin, funding) mattered. Investors repriced growth, default risk, and correlation assumptions almost daily.

Typical performance pattern: Equities fell quickly; credit spreads widened dramatically; some safe havens worked (high-quality sovereign duration ultimately helped), but there were intervals where “dash for cash” dynamics caused unusual co-moves; gold and the dollar displayed stress-driven behavior rather than a single, tidy narrative; commodities tied to mobility and growth were hit especially hard.

2022: Inflation uncertainty and rates volatility as the “center of gravity”

When inflation is the primary uncertainty, rates volatility can become the engine that drives everything else. In that environment, the classic stock–bond diversification can fail because rising yields are not a “growth shock hedge” but the shock itself.

Typical performance pattern: Both equities and longer-duration bonds can decline together; credit suffers from both widening spreads and higher discount rates; the dollar can be strong; commodities may outperform if they are part of the inflation impulse, though dispersion across commodities can be huge.

What High Vol-of-Vol Teaches Us about Asset-Class Behavior

Across these episodes, a few recurring truths show up:

Correlation is conditional. In tranquil periods, asset classes appear diversifying; in stress, correlations often rise because the shared factor becomes liquidity and risk appetite, not idiosyncratic fundamentals.

Convexity is expensive for a reason. Options feel “overpriced” right up until they don’t. High vol-of-vol is the market’s reminder that protection is not about predicting the event; it’s about surviving the regime shift.

Liquidity is an asset class. During high vol-of-vol, instruments that trade continuously with deep markets (cash, on-the-run sovereigns) gain a premium relative to less liquid credit, small caps, certain EM exposures, and complex structured products.

The driver matters: growth shock vs inflation shock vs plumbing shock. A growth scare often helps duration; an inflation scare can hurt it; a funding/liquidity shock can temporarily distort everything.

Application Beyond Markets: Why There Are "Weeks Where Decades Happen”

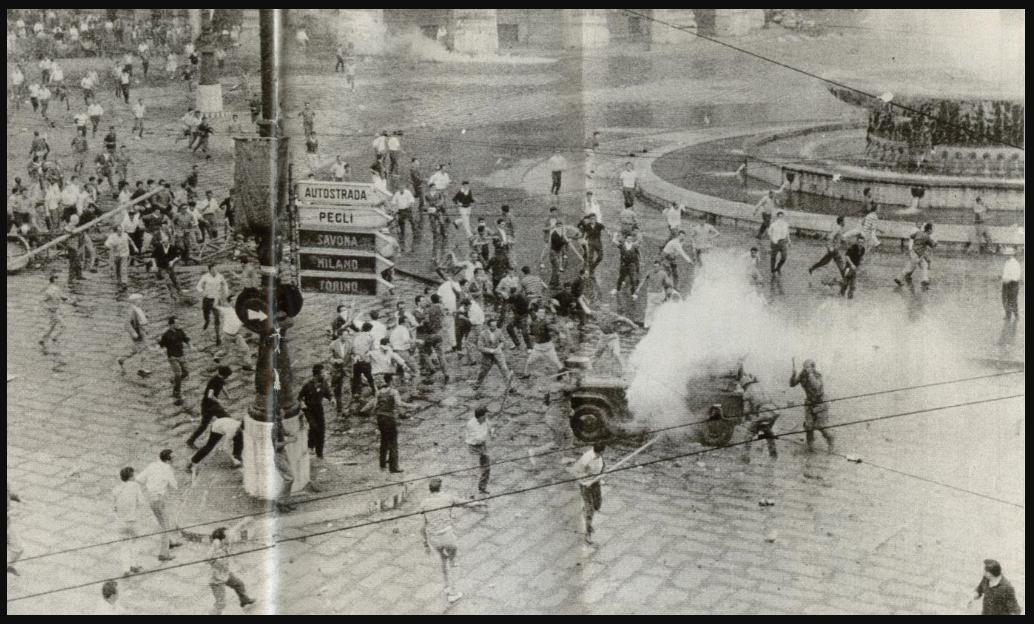

Lenin's famous line "There are decades where nothing happens and weeks where decades happen" is essentially heteroskedasticity in human time. Most weeks are low-variance: Routines dominate, surprises are small, memory compresses. Then a high-variance week arrives – a health scare, a breakup, a layoff, a move, a crisis – and the “variance of outcomes” expands. Decision-making becomes more fragile, second-order uncertainty rises (“I don’t even know what next week looks like”), and you experience something like personal vol-of-vol: not just intense events, but rapidly changing expectations about what is possible.

The practical takeaway mirrors risk management. In calm periods, build slack, skills and resilience: Sleep, savings, relationships, accuracy, fitness, etc. Calm itself does not cause storms, but it is the only time you can cheaply prepare for them. And in the storm weeks, judge yourself by your robustness rather than optimization: Smaller plans, shorter horizons, fewer irreversible decisions. Markets call it surviving a regime shift; life calls it getting through a decade-long week.

Remember: Perfection is the enemy of the Good.