Just buy ponzis!

I came across this tweet yesterday and found myself mulling it over. "It could be true, it sounds compelling; the guy is confident...," I thought. Then I saw Daniel Oliver's response and gave it a second thought...

Original Tweet in Question:

"In the midst of the strongest technological revolution in all of human history (and it's not even close), the Chinese buy gold. Just shows you, you buy what you are forced to buy.

If I wanted to sink China forever and the CIA asked me to come up with an economic black ops, this is exactly what I would come up with: force them to invest in the most unproductive asset out there, which you can do nothing with but bury in a hole again.

Daniel Oliver's Response:

"... Look I get it, there are lots of investors who made their careers off stocks and bonds, paper assets with counterparty risk. There's nothing wrong with that, but this is almost like willful ignorance of what gold is and the purpose it serves as the most permanent form of savings in the world (with no counterparty risk). It will outlast all technologies and all economies just as it has done for millennia.

On another note, I'm extremely doubtful of AI being the strongest technological revolution in human history, but that's really just an opinion at this point."

POST: https://twitter.com/Oliver_MSA/status/1777507284672717107

Ironically, Nick Giva's statement seems like exactly the sort of propaganda the CIA would disseminate through its various proxies:

"No need for sovereign hard money! Just buy ponzis!"

The KEY part again:

"If I wanted to sink China forever and the CIA asked me to come up with an economic black ops, this is exactly what I would come up with: force them to invest in the most unproductive asset out there, which you can do nothing with but bury in a hole again."

Looking at this statement from an adversarial point of view, we would imagine that The Powers That Be might just dream up such an "Economic Black Ops" to prevent Western investors from protecting their wealth through the use of hard money right before a crash.

Gold may not be the "best" hard money. Arguably, there are better assets to own (bitcoin?), but gold is not a bad hedge at all. In fact, it is doubtful that any Chinese investor is being "forced" to buy gold.

Sure, they may not have any other good options for wealth protection, or may not be eligible to invest in US Tech Stocks. But they are not being forced to buy gold. They are being forced to use Fiat Currency.

As always, you have to look at Who Benefits and Who Loses in every potentially adversarial scenario. In my humble view, it is the Holders of Hard Money who will win out over the next 5-10 years.

REFERENCES:

--- original tweet quoted by Nick Giva ---

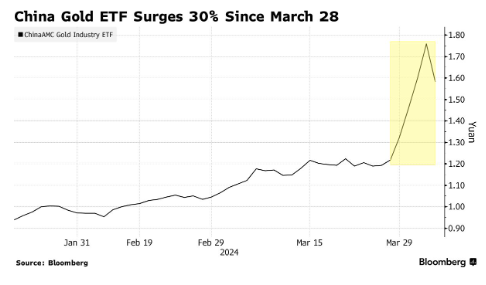

"Chinese demand is still the important driver." https://www.bloomberg.com/news/articles/2024-04-08/chinese-fund-house-halts-gold-linked-etf-after-premium-surge

POST: https://twitter.com/BobEUnlimited/status/1777280468359971203

Tweet from top of Bob's original thread:

"Gold pushing new all time highs despite broad hatred in the US, higher dollar, and tighter dollar US monetary policy expectations suggests the surge in demand is from abroad, particularly China. Gold price is rising even as US ETF assets keep falling:"

POST: https://twitter.com/BobEUnlimited/status/1765007203302346780