Poor US Household Savings Strategies

What does life look like for the poorest 25% of US households?

Here is the Interquartile Range for Net Worth, US Households:

- 25th Percentile (Q1): The net worth at the 25th percentile is around $16,000.

- 75th Percentile (Q3): The net worth at the 75th percentile is approximately $405,000.

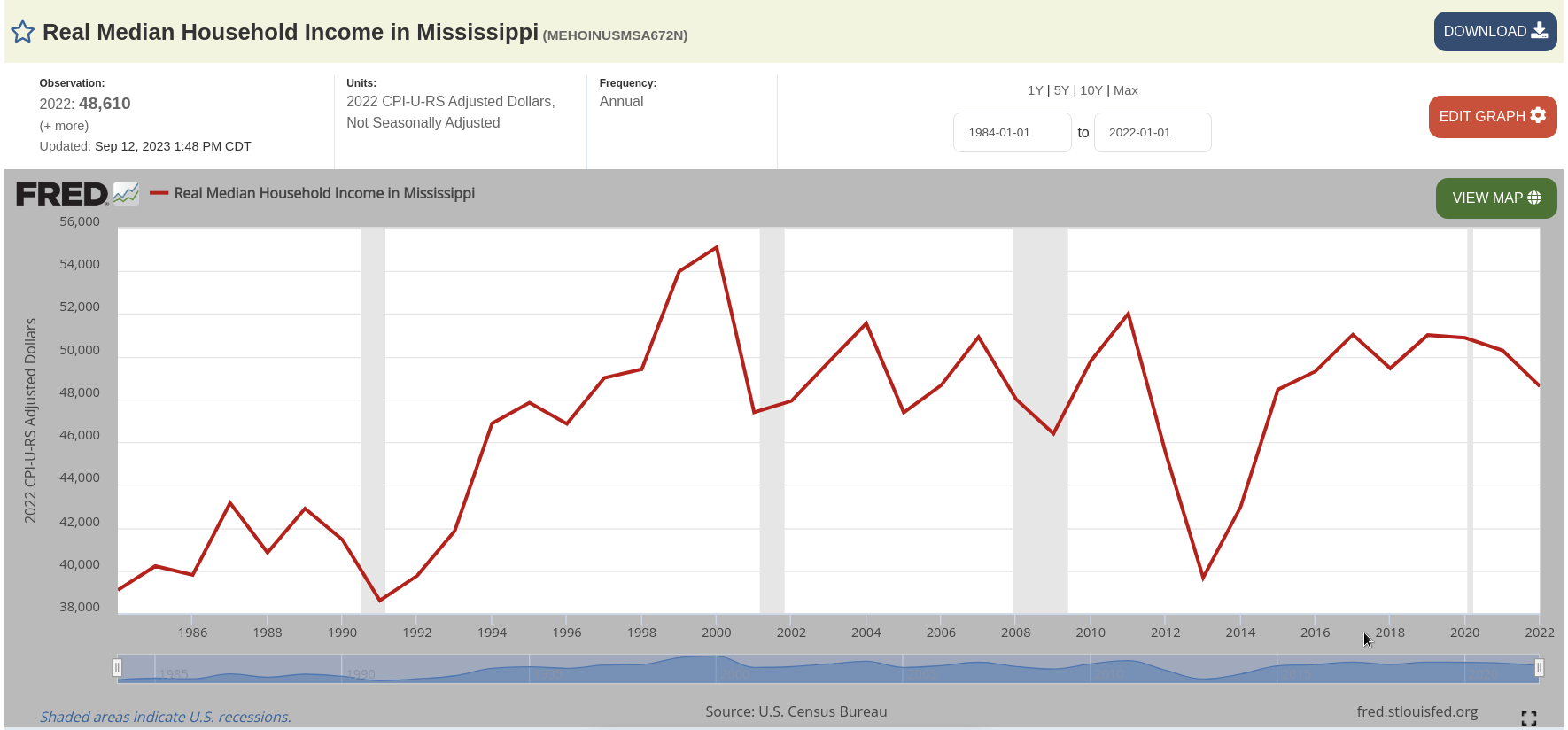

Median Household Income in the Poorest 3 US States is as follows:

- Mississippi: The median household income in Mississippi is approximately $48,610, the lowest in the nation.

- Arkansas: Median household income is around $53,980.

- Louisiana: Median household income is about $58,330.

Let's say your household income is $50,000 and your net wealth is $5,000, primarily in home equity.

What are some strategies for you to pay off any high-interest debts (e.g. $3000 in credit card debt), and begin accumulating savings so you can reach the "6 months emergency savings" level?

If your household income is $50,000 with a net wealth of $5,000 (primarily in home equity) and you have $3,000 in high-interest credit card debt, you can adopt several strategies to pay off the debt and start building your emergency fund.

"The key to managing debt and building savings is discipline and consistent effort."

Here’s a step-by-step approach:

- Assess and Prioritize Debt Repayment

- Focus on High-Interest Debt: Start by prioritizing the $3,000 credit card debt, as it typically carries a high interest rate (often 15-25%). Paying off this debt quickly will reduce the amount you lose to interest.

- Snowball vs. Avalanche Method – For if you have other debts:

- Avalanche Method: Pay off debts with the highest interest rate first. This is the most financially efficient in the long run.

- Snowball Method: Pay off the smallest debt first to gain momentum. This is the most psychologically rewarding for most people.

- Choose the strategy that works best for you.

"If the interest rate on your credit card is 25%, paying it off quickly could save you hundreds of dollars in interest."

2. Create a Budget and Identify Savings Opportunities

- Track Your Expenses: Use budgeting tools or apps (e.g., Mint, YNAB) to track your spending and identify areas where you can cut back.

- Reduce Non-Essential Spending: Consider reducing expenses on dining out, subscriptions, or entertainment temporarily until the debt is paid off.

- Automate Savings: Set up an automatic transfer to a savings account on payday to ensure you save before spending.

"If you can free up $200 per month by reducing discretionary spending, you can apply this toward your debt and then toward savings."

3. Increase Income

- Side Hustles: Consider part-time work, freelancing, or gig economy jobs (e.g., Uber, TaskRabbit) to bring in extra income.

- Sell Unused Items: Sell items you no longer need (e.g., electronics, clothing, furniture) through platforms like eBay or Facebook Marketplace.

"An additional $200 per month from a side hustle can be directed toward your debt repayment and savings."

4. Build an Emergency Fund

- Start Small: Initially, aim for a smaller emergency fund, such as $500 or $1,000, to cover minor unexpected expenses.

- Gradually Increase Savings: After paying off your credit card debt, redirect the funds you were using for debt repayment into your emergency savings.

- 6-Month Emergency Savings Target: $21,000

"Assuming monthly expenses of $3,500, your target for a 6-month emergency fund would be approximately $21,000. (SEE: Cost of Living Breakdown below.)"

5. Consider Debt Consolidation (If Applicable)

- Balance Transfer Credit Cards: If you qualify, a balance transfer credit card with a 0% introductory APR could help you pay down the debt without accruing more interest.

- Personal Loans: If your credit is good, you might consider a personal loan with a lower interest rate to pay off the high-interest debt, though this can be risky if it extends the repayment period.

6. Build Long-Term Financial Habits

- Consistent Savings: Continue to save consistently, even after reaching your emergency fund goal.

- Invest for the Future: Once you have a sufficient emergency fund, consider investments like Certificates of Deposit (CDs), gold, stock index funds (VTI), rental properties or bitcoin to grow your wealth over time.

The key to managing debt and building savings is discipline and consistent effort. By focusing on paying off high-interest debt first, reducing unnecessary expenses, and gradually building an emergency fund, you can achieve greater financial security.

These strategies should be tailored to your specific situation, but they provide a solid foundation for improving your financial health.

Cost of Living Breakdown

The average monthly expenses for a family of four in a second-tier city in one of the poorest states (Mississippi, Arkansas, or Louisiana) can vary widely, but here's a breakdown of what typical costs might look like based on recent data:

Housing – Rent/Mortgage: In a second-tier city in these states, rent for a 3-bedroom home or apartment is likely to range between $800 to $1,200 per month. If the family owns a home, mortgage payments might be similar, though they could vary based on down payment and interest rates.

Utilities – Electricity, Water, Gas, Internet, and Trash: Utilities for a family of four might total around $300 to $400 per month, depending on usage and the season.

Food – Groceries: The average cost for groceries for a family of four can be between $600 to $800 per month, assuming a mix of home-cooked meals and some occasional dining out. This can vary based on dietary needs and preferences.

Transportation – Car Payments, Insurance, and Fuel: If the family has two cars, which is common in many parts of the U.S., they might spend around $500 to $800 per month. This includes car payments, insurance, and fuel. Fuel costs can vary significantly based on driving habits and local gas prices.

Health Insurance – For a family of four, health insurance could cost around $400 to $800 per month, depending on whether they receive coverage through an employer or purchase it independently.

Childcare and Education – If both parents work, daycare or after-school care could be a significant expense. This could range from $400 to $800 per child per month. If the children are in public school, these costs could be lower, but extracurricular activities, school supplies, and other fees might still add up to around $100 to $200 per month.

Miscellaneous – Clothing, Entertainment, and Other Expenses: Things like clothing, entertainment, and personal care might total around $300 to $500 per month.

The total average monthly expenses for a family of four in a second-tier city in one of the poorest states is likely to be around $2,900 to $4,500 per month, depending on lifestyle choices, the exact location within the state, and other factors.

For discussion above, we chose $3,500, for a family in the lower quartile of wealth and income, to be conservative.

Tier II Cities in the Poorest 3 US States

Mississippi:

- Gulfport, population: 71,000 – a coastal city and part of the Gulfport-Biloxi metropolitan area. 2nd largest city in Mississippi, known for its port, tourism, and military presence.

- Hattiesburg, population: 46,000 – home to the University of Southern Mississippi. Diversified economy includes education, healthcare, and manufacturing.

- Southaven, population: 55,000 – just south of Memphis, Tennessee. Southaven is part of the Memphis metropo area. Growing rapidly, with significant retail and residential development.

Arkansas:

- Fayetteville, population: 95,000 – 3rd largest city in Arkansas. Home to the University of Arkansas. Part of Northwest Arkansas region, which is a significant economic hub in the state.

- Fort Smith, population: 89,000 – On the Arkansas-Oklahoma border. Fort Smith has a history rooted in military and manufacturing industries. Fort Smith metro area.

- Jonesboro, population: 80,000 – Regional center for education and healthcare. Arkansas State University is a major employer. Known for its agriculture and manufacturing sectors.

Louisiana:

- Shreveport, population 187,000 – One of the largest cities in Louisiana. Northwestern part of the state. Diverse economy with sectors including healthcare, manufacturing, and gaming.

- Lafayette, population: 126,000 – The heart of Louisiana’s Cajun and Creole cultures. Strong oil and gas industry presence, along with healthcare and education.

- Lake Charles, population: 84,000 – Southwestern Louisiana. Significant industrial base, particularly in petrochemicals and refining, along with a growing gaming industry.

Best of luck