Macro Musings #0001

TL;DR: Short-term bearish bitcoin and risk assets.

There is a chance that the Fed raises rates again in June.

It is likely that the balance sheet roll-off will continue as well, as they said it would.

It has been a year now of rapidly raising rates and quantitative tightening (shrinking the money supply). The result is that multiple banks have failed. Private Real Estate funds have gated redemptions. And lending standards are extremely tight.

This is all contractionary for the economy.

But, importantly, nothing has blown up yet. Rather, small things have blown up, but have been quickly contained (see: BTFP, FDIC, Discount Window). People still have jobs, and inflation is still high (even if you believe the government's own numbers).

I don't know how much longer this state of affairs can continue. But I do know it would take a massive deflationary shock for the Fed to actually pivot, cut rates and restart QE at this point.

Anything else would be capitulation on the part of the Fed: Pausing too soon and ending QT now would equate to an "Arthur Burns Fed", not a "Volcker's 2nd Coming Fed", the latter projection of which they are desperate to maintain.

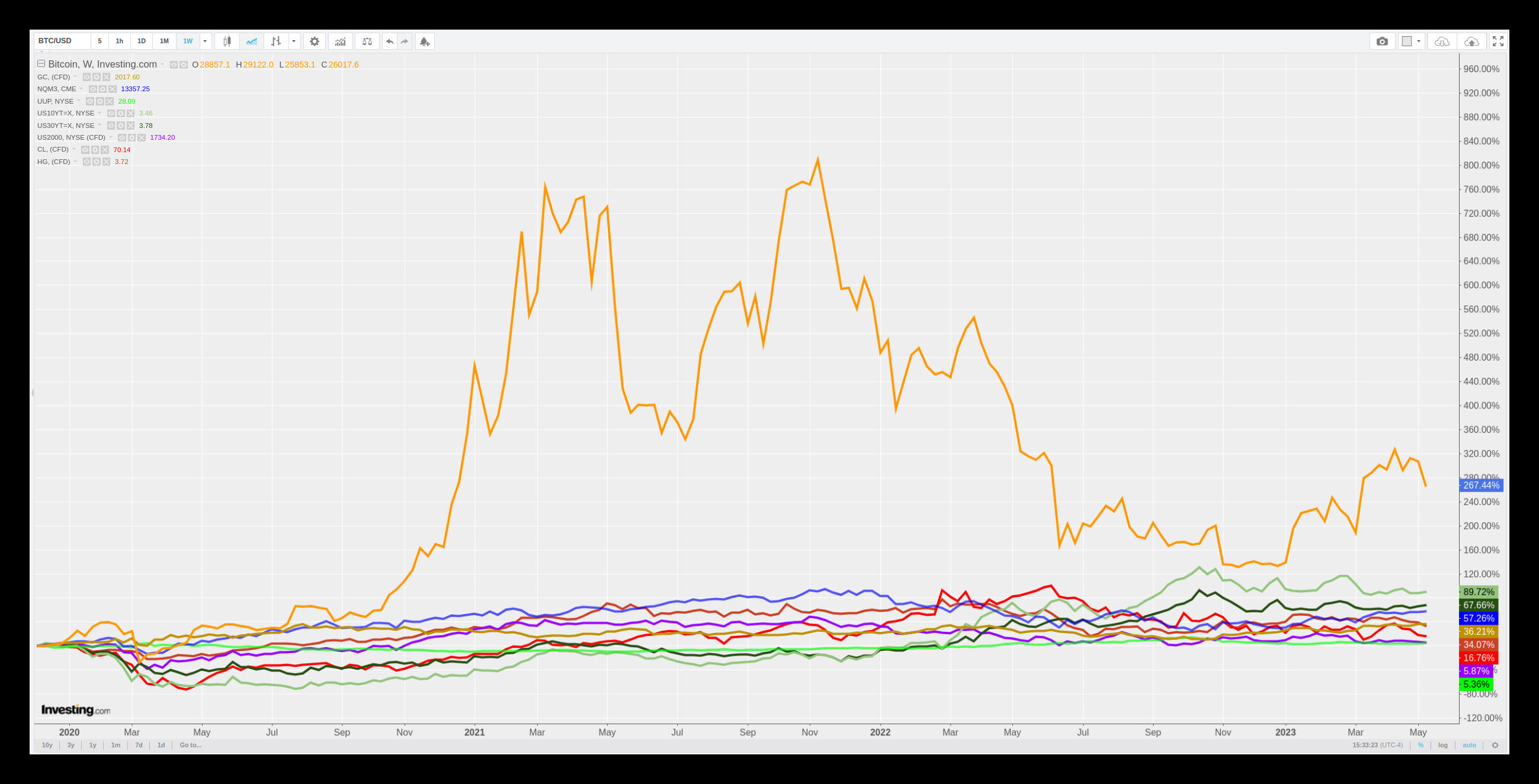

Assets to keep an eye on here are: Copper, Oil, Gold, Bitcoin, USD, 10Y rates, 30Y rates, the Nasdaq and the Russell 2000. (See chart at top.)

In the "risk on" bucket, you can place Copper, Oil, Bitcoin, the Nasdaq and the Russell.

In the "risk off" bucket you can place the USD, the 10Y and the 30Y.

Gold is somewhere in the middle as a non-correlated asset and hedge against currency debasement. Some of Gold's moves are more in anticipation of Fed Easing and other forms of Central Bank Profligacy.

Bitcoin is a mix between Nasdaq and Gold as far as how it moves (in the current regime). If Gold and Bitcoin go up, while the Nasdaq and other indices goes down, that would signal a "flight to safety" trade in terms of hedging incoming money printing.

While I still think it's important to own Bitcoin, and to a lesser extent Gold, I am short-term bearish on the prices of these and other risk assets, until and unless something different happens and things really break down in the financial system.

Think: A 20% daily drop in BTC, or a 5-10% daily drop in Gold, for example.

Maybe we retest the $15,000 level or thereabouts in Bitcoin. Or maybe $25,000 is support. I don't know for sure. But I do know the Fed is not pivoting yet.

Ultimately, it's not until sometime after a Fed Pivot, maybe a few months after, that you would typically want to get "irresponsibly long" risk.

Remember: Markets can stay distorted longer than you can stay solvent. Hedge your bets and avoid leverage.