Place Your Bets

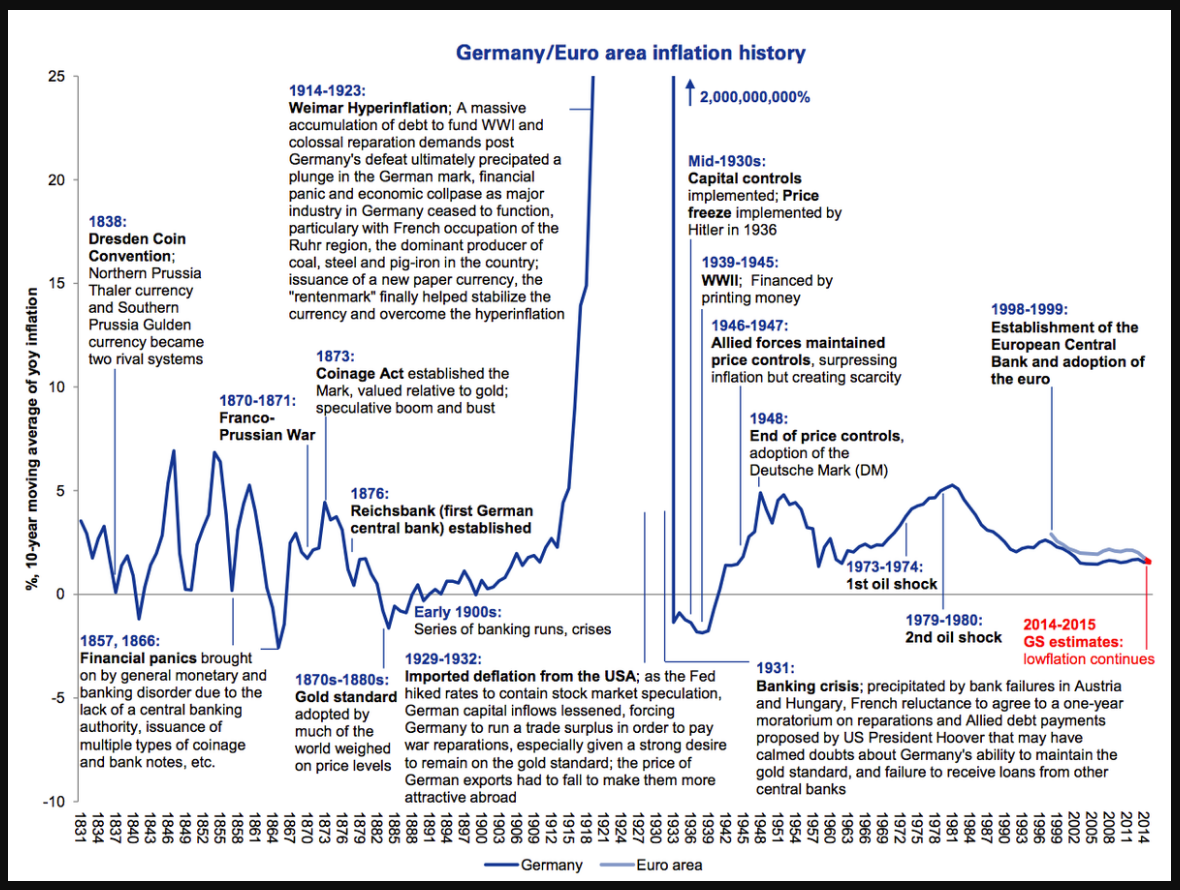

You can bet on central banks not being able to stop themselves from printing money.

And you can bet on central banks printing money not being enough to stave off another crisis.

These bets are not the same.

~

Gold and bitcoin have both performed well during recent episodes of rapid money printing.

With long and variable lags, confounded by a rising rate environment, these assets have seen great volatility.

Arguably their owners have come out better-off in real terms over the last four years, through the 'covid pandemic monetary yo-yo' period.

~

However, if and when a severe shock hits and asset prices drop, bitcoin and gold will likely fall again along with everything else.

In that case, it's better to own some cash (preferably physical cash).

~

Hardcore bitcoin and gold people may not like this advice, but if your 'savings runway' is short and your standard of living over the subsequent 2-3 years would deteriorate materially by dint of either asset class getting cut in half (or worse), then it's probably a good idea to set some cash aside as a buffer.

Absent a crash, the cash buffer could lose 10-20% a year if inflation remains sticky, of course. But, by contrast, this cash could tide you over (i.e. help you survive) a severe crash in the markets and/or a prolonged downturn in the economy. (This would also allow you to buy on dips if you are so inclined.)

~

It's all a matter of how deep and severe a crash we get, as well as how quickly and voluminous is the money printing that follows... Last time around, it was, in hindsight, best to immediately deploy all cash into gold or bitcoin at the height of the panic. Next time around, I am not sure I would want to wager it will play out exactly the same way.

And there's always the possibility that the money printing just won't work again.

You may see things differently, and that's fine. But I think it's time to...

PLACE YOUR BETS