Run back expectations

[0 phreaking AI was used for this post!!!]

Lots of gurus hype eye-popping returns for real estate. But the numbers and assumptions they use are pretty bogus. The first problem is their lookback period. If you're only looking at performance from the bottom of the housing market after the great recession to the end of the money-printer-go-brrrr period post-plandemic, then your numbers are goosed from the start. 30-year rates fell down to 2-3% around the time fake videos were being promulgated of chinese men falling flat dead instantly in the streets from wuhan flu. House prices hadn't caught up yet or overtaken the currency pile doubling that happened, and yet you could borrow like the USG and get yourself some sweet A-class duplexes in middling cities. With 20% down or less, your equity probably doubled or tripled if you just held for 2 years. Now debt costs are 2-3x times higher, and prices have been jacked up level with the stack of benjamins packed into pallets made with 3 year old pine and upcycled rusty nails. Now? Forward returns ain't so peachy...

Lots of vacuous blue-checks shill galaxy-brain returns for bitcoin too. Again the numbers and starting points are total bullocks. Miners are accepting sub-phreakin-sat-per-vbyte transactions with full 1911 CAD files etched into them. Onchain is only a thing because 1000 die-hards are starting to whirlpool again thanks to the G's at Ashigaru keeping it real. Adoption is a joke lamer than Nic Carter pretending to speak Spanish in 2021 when Bukele larped everyone into reviving the nation-state-hyperadoption thesis. Treasury co's are hiring influencers to help them sweep it all under the rug now cause ETFs didn't materially impact the logarithmically falling CAGR of bitcoin that's been in place since Laszlo bought two pizzas for 10,000 bitcoins 15 years ago.

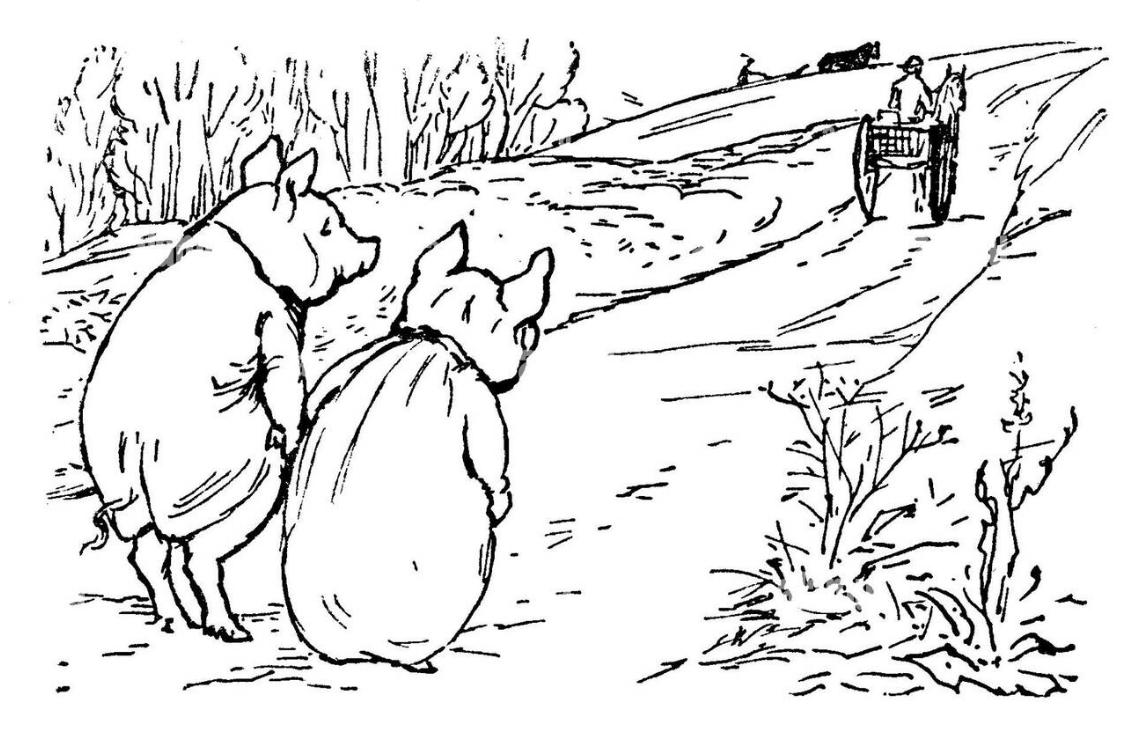

There's still money to be made in real estate, but you're gonna have to work for it and be discerning about how much money you put down, how much cash flow per door is realistic, and which markets you select. Build in large cash buffers of like 6 months' worth of rent and find good property managers that will keep everyone cool. Assume your CapEx is like 30-40% of rent. Then figure out if you've got an alligator or a 'cash-calf'. (If DSCR loans are 7% and you still net $100-200 per door with these assumptions, then the calf may grow into a decent cash cow in 5-7 years.)

And bitcoin? Not a bad place to park your money. But you should have massive red flags shoot up in your mind if you ever come across bitcoin FIRE people trying to pitch the notion that it's going up forever laura. It's not. It might beat the S&P 500 over the next 10 years. But over the next 20, who knows?

I say, spread your bets. Keep some bitcoin, some real estate or land investments, private enterprises or side hussles, gold, stocks, some mix of the above. And keep using your money tokens. Bitcoin and Monero are meant to be used. Not just hoarded like it's some kind of ancient spell of protection that will shield your great-grandchildren from gangs of heathen transgender carteleros in the year 2110.

Run back your expectations. Keep it real.