Scale In, Scale Out Portfolio

"How to not go broke quickly." – or – "How to get rich gradually."

Before you do anything, start by figuring out your total yearly/monthly/weekly expenses.

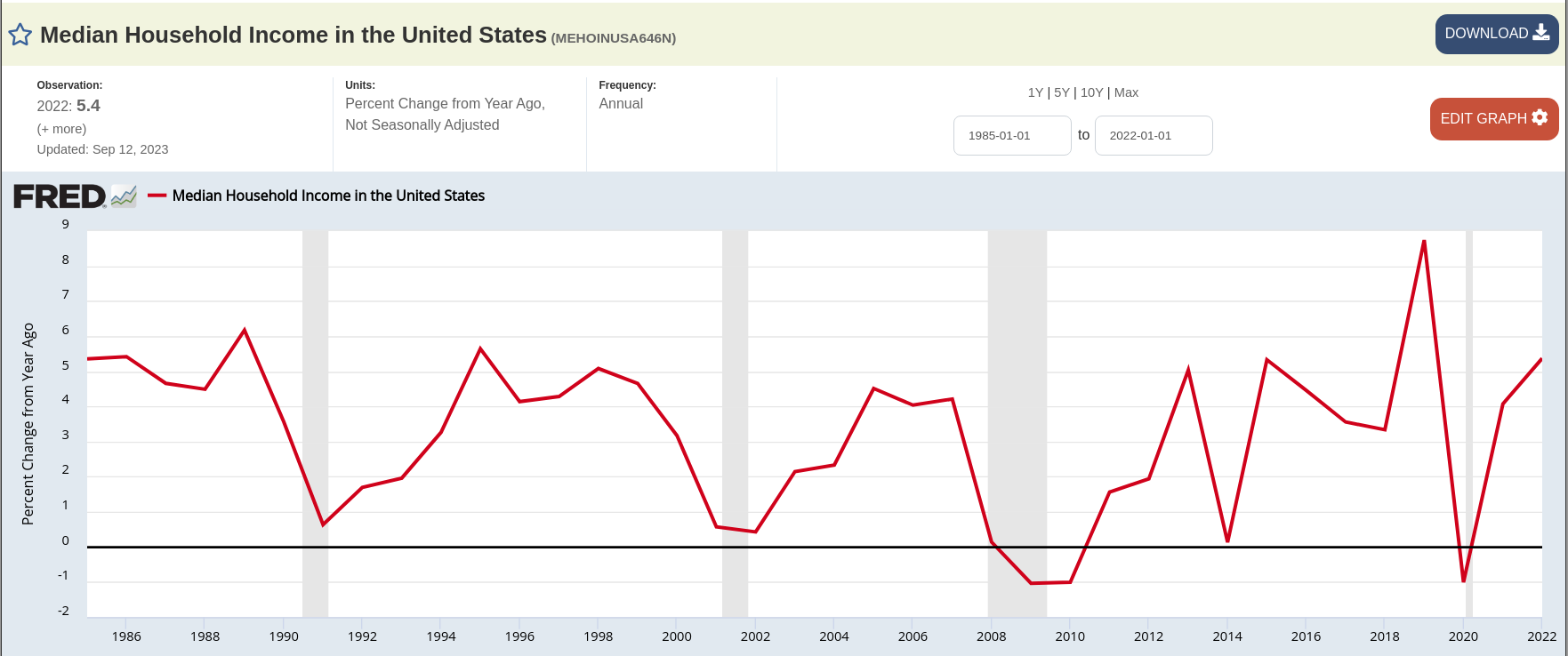

As of 2023, the real median household income in the United States was approximately $75,000.

Let's say with your current lifestyle your average yearly expenses come out to $72,000.

Great job! This means you can save $3,000 a year to start.

The Scale-In Portion

With the Scale In, Scale Out Portfolio, you prioritize saving up a few months' worth of expenses before expanding your investments into other categories.

The first category is "pure money". This can be any combination of Cash, Gold or Bitcoin.

To start Scaling In, first save up 1 week's and then 1 month's worth of cash.

If your yearly expenses are $72,000, then your monthly expenses equal $6,000 and your weekly expenses come out to about $1,385. So these would be your first savings targets.

If you don't like having all of this in cash, then split it up 50/50 into a 'Hard Money': e.g. 50% Cash, 50% BTC.

Just beware with the volatility of bitcoin, you should probably save twice as much of it, because the price could drop sharply over the course of any given month. It could also potentially rise sharply during that time frame, but this is about creating a cash or cash-like buffer for yourself, so we are being conservative.

Keep it conservative.

Realistically, if you are going 50/50 Cash/BTC from the get-go, to be safe you should then target:

- 1 Week's Worth = $693 cash + $1,385 of BTC

- 1 Month's Worth = $3,000 of cash + $6,000 of BTC

Continue to Scale In

Continue this process until you have 3-4 month's worth of funds saved up. This is meant to be liquid money that can be used quickly in an emergency or in case you lose your job.

Imagine what 4 month's of reserves might look like:

- You have $6,000 cash

- You have $12,000 bitcoin, and

- You have $6,000 gold

(Remix the above if you don't want BTC, or gold, for that matter.)

With only $3,000 to save each year, this might take a while, but you'll make it if you're careful with your spending. And you'll reach your goal faster if you can find more ways to make money or get a raise. So keep working hard, keep networking with people, and create some more good luck for yourself.

Work hard. Network with people. And make your own luck!

This end result is an insurance policy on your current lifestyle. As such, it should be kept segregated from your other monies you use for business and pleasure.

Scale Out

Imagine you have sudden unexpected expenses after saving up only 2 month's worth of funds. Say a large medical bill to the tune of $20,000. It sucks, but at least you had some money saved up, and you didn't need to use your credit card so much.

To Scale Out at this point, you simply liquidate your monies and make a payment. Cover additional expenses with credit if you need. And then pay off your debt as soon as possible.

Life Happens

I've been through numerous cycles of building savings and having to liquidate them for various life events over the past 5-10 years and I know it can be hard. But you can always start over again if you need to.

The benefit to this Scale In, Scale Out model is that you're allocating money every week to an insurance policy with a known, more-or-less fixed quantity of risk. (To this point, I recommend keeping no more than 50% of this 'pure money' fund in bitcoin for this reason. Read on to see how you can allocate more to bitcoin later on in the process.)

Scale In and Beyond

So now you've been through a Life Event, paid off the resulting debt and are back saving again. Despite your setbacks, because you worked hard and got a raise, you hit your goal after 3 years. You now have a decent nest egg.

Assuming you haven't inflated your lifestyle (spending more money), then you can branch out or just add more reserves to your system.

If you're a diehard bitcoiner, you can start allocating more to bitcoin each month.

If you're a hardcore goldbug, you can buy more bullion or start investing in the miners.

And if you're interested in Stocks, Bonds or Real Estate, you can start putting money there too.

Another Major Expense

The next time you have a major expense, you can unwind portions of your portfolio to cover it.

There are differing philosophies here. Some would say you should use up all your excess cash first. Others would say liquidate the 'most risky' part (e.g. bitcoin or stocks) first.

My intuition about this is that the Emergency Fund should be maintained as long as possible. So I would tend to want to liquidate any excess gold/bitcoin, or the Stocks/Bonds/Real Estate first.

The most liquid things would be good candidates. For example, a short-term bond fund, or a broad equity market index fund. These can be sold more easily than Real Estate, for example. This is one reason why I like having a brokerage account, even if I don't keep anything in it during the initial Scale-In portion of my journey. Later on, it's a good place to invest or park excess reserves. Everything else in the emergency fund I like to keep fully in my possession as much as possible.

Repeat and Scale Up

Keep refilling your Scale-In Emergency Fund any time it gets depleted. Keep these funds segregated from the rest of your cash and assets.

Keep your eyes on the prize.

Keep in mind your next targets as you go too. Start small, but keep your eyes on the prize. While saving up your first Week's worth of funds, imagine how you'll feel with one Month's worth. While approaching your 1 Month target, consider how you'll feel having 3 Month's or even 1 Year's Worth of Savings on hand.

The goal is to build security for yourself and your loved ones over time.

Over the course of 10 or 20 years, you can build true wealth this way. It doesn't have to be complicated, but you do have to be consistent and avoid emotional trading and FOMO'ing in and out of positions.

Good Luck!