The Anti-FOMO Portfolio

Even if you can only invest 1% of your income every year, do it! The longer you wait, the more you miss out on compounding of your wealth.

Starting Assumptions

- Your investment and savings plan should not be motivated out of envy, greed, or any of the other cardinal sins.

- Your investment and savings plan should be grounded in long-term thinking and pragmatism.

- As a starting point, you should balance your budget.

- If you aren't currently able to save and keep more than 1% of what you earn every month, then look first to reduce spending and cut back on expenses (there are millions of blog posts on this topic if you care to look).

Read on if you have a balanced budget and are able to save at least 1% of what you bring in every month. (If not, check out all the links above for some tips on saving more money. Or find more ways to earn money.)

How you choose to invest or save your money should be driven by your end goal, your personal orientation (risk tolerance and disposition), and by your knowledge.

The end goal may be the easiest to define or synthesize into the investment or savings plan. Do you want to buy a house? Do you want to retire in 20 years? Do you want to start a business? It's really a matter of reflection and deliberation on what you want, combined with setting a time frame and estimating what you'll need in monetary terms to meet your goal.

Start with Pragmatism

If your goal is to retire in 20 years and you currently have less than 1 year's salary saved up AND you are contributing less than 10% of your income to your investments you will be hard-pressed to retire and live off your assets at anywhere near half the level of your current income.

Put another way, if you want to be able to retire in 20 years, you either should have already saved up 2 years worth of your salary, or you should be contributing 20% of your income to your savings and investment plan. NOTE: This is assuming your portfolio grows at a 10% compound annual growth rate and that inflation is 0% (both tough assumptions to make).

Backing up a second, if we make much more conservative assumptions: Inflation is 5% on average for the next 20 years (ouch! but probably true); Your portfolio grows by 5% per year after inflation. In that case, if you want to retire in 20 years, you will have needed to have saved already 2 years' worth of your salary, and then additionally put away 25% of what you earn each year going forward.

To give a concrete example, let's take the oft-cited figure of 4% safe-withdrawal rates, and invent a couple by the name of Mr. & Mrs. Jones. The Jones bring in $100,000 a year. They save 25% a year ($25,000) and invest 80% in the US stock market, with 20% in bonds. They have already saved up $200,000 (two years' salary). In 20 years, their theoretical portfolio will be worth $1,357,000. Assuming they can survive on $50,000 a year (half their current income), they can safely withdrawal 4% per year from their portfolio in perpetuity.

This example is admittedly a little contrived, but it gives you a sense of how conservative and pragmatic you need to be if you want any surety about being able to achieve your goals.

Evolving the Money

What if we switch to a bitcoin standard? Or if not a bitcoin standard, per se, at least upgrade our asset allocation to include bitcoin?

In the previous example, I take a very conservative approach to estimating future returns on a more-or-less traditional portfolio of 80% stocks and 20% bonds. I assume this portfolio will return only 5% after inflation on an annualized basis for the next 20 years.

Now, if you are personally very risk-averse and don't know anything about bitcoin, this is where you have the chance to learn something new and maybe challenge your existing notions a bit.

Let's assume you know nothing about bitcoin and I tell you the following 3 facts about it:

- It is the most scarce commodity to ever exist (max of 21 million units)

- Less than 10% of the world owns any in the year 2022

- Anyone can send it over the internet and use it as money

Just knowing these 3 things about bitcoin, and that fact that nothing else in the world has all of these attributes, you are already more knowledgeable about bitcoin than the majority of the population.

Now what if we add a 4th and 5th fact about it's historical returns over the last 10 years and the last 5 years:

- 10-year inflation-adjusted return: 140% per year

- 5-year inflation-adjusted return: 105% per year

Evolving Portfolio

Taking what we know about bitcoin being in an early phase of adoption, being absolutely scarce, and having the incredible returns it has had, let's adjust the 80/20 portfolio.

If you assume, like I do, that inflation is going to stick around, perhaps it makes sense to dump some of our bonds for bitcoin...

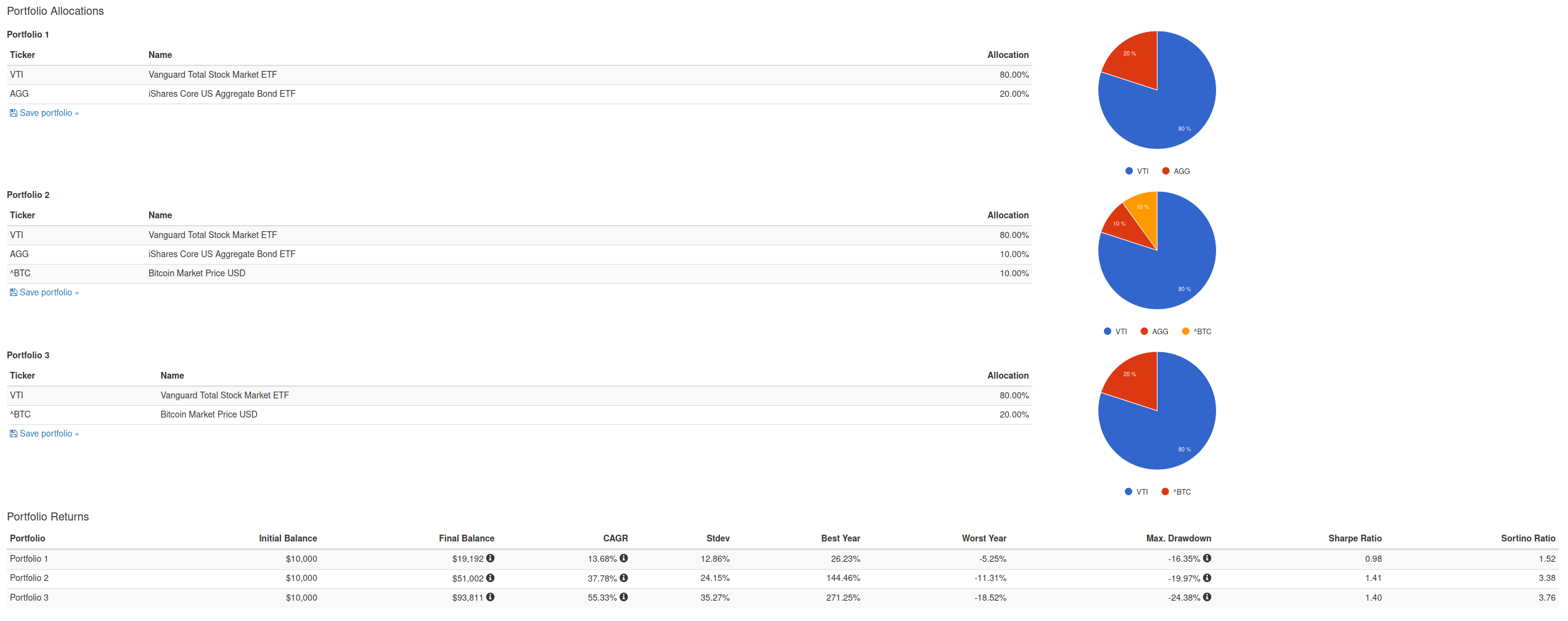

The 80/20 stock/bond portfolio has returned around 13% CAGR over the last 5 years, not factoring in inflation.

If we switch out 10% of the portfolio that's allocated to bonds, and move it into bitcoin, returns jump to almost 38%. Nearly 3x better than the 80/20 portfolio.

If we switch out all of the bonds instead and allocate it to bitcoin, the returns jump again to 55% annualized.

NOTE: I use Portfolio Visualizer's 'Backtest Portfolio' tool with the tickers VTI, AGG and ^BTC for this simulation.

For the risk-averse, I will provide the counter-argument to making such shifts: The maximum drawdown for the 80/20 stock/bitcoin portfolio is 50% larger than that of the 80/20 stock/bond portfolio, and the "Worst Year" is 3 times worse.

Basically, you have to be able to stomach a lot more downside volatility if you allocate to bitcoin instead of bonds.

Portfolio Construction

If your goal is to both increase your total annualized return and reduce drawdowns, you would ideally use 'Higher CAGR', 'Lower Worst Year' and 'Lower Max Drawdown' as your metrics.

Playing around with the Portfolio Visualizer tool may help to inform your views on how to construct such a portfolio, but it's ultimately of limited use, as it's based on historical returns. It has no real predictive power.

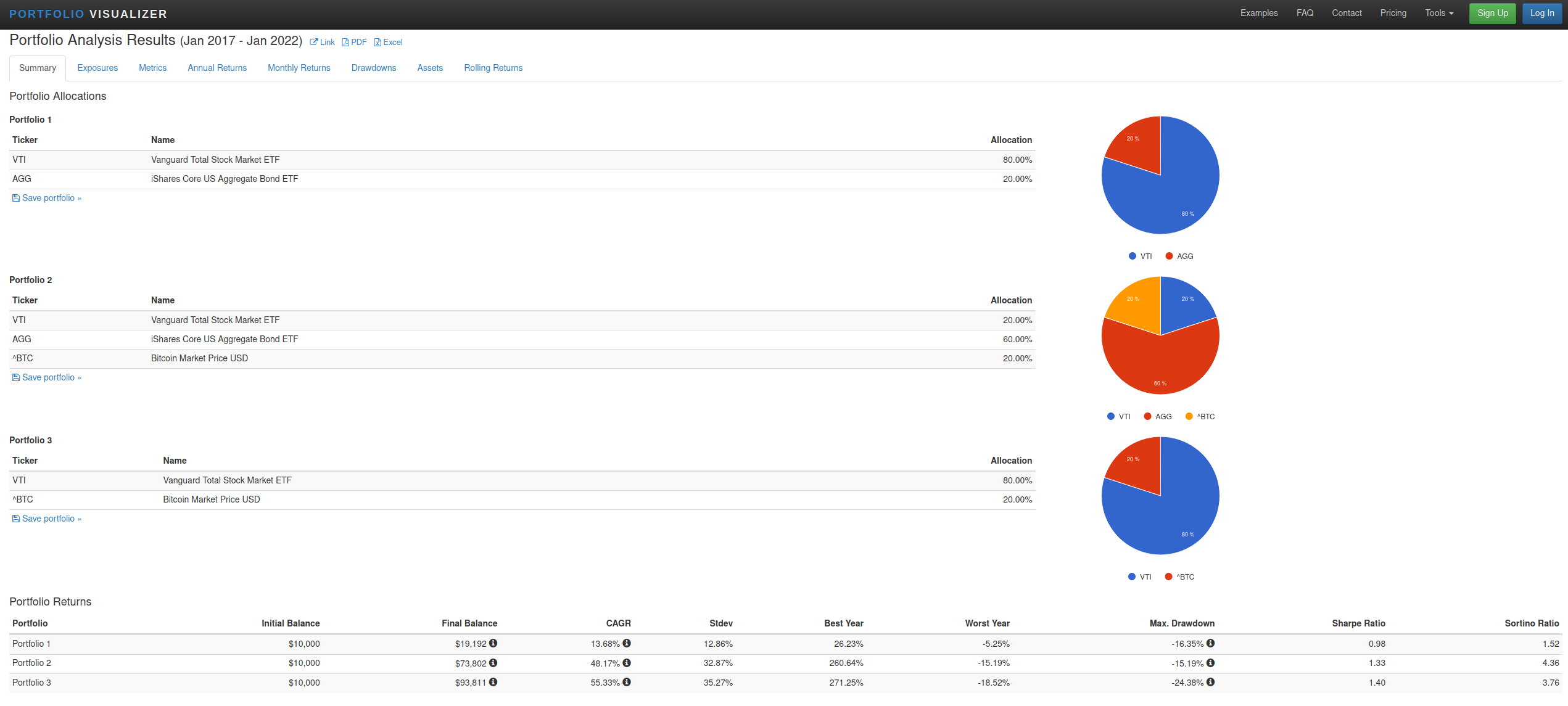

But for the curious ones in the audience, I was able to "constuct" a hypothetical portolio (again, backwards-looking) that met the criteria I listed above (higher returns for lower risk). It looks like this:

- 20% stocks (VTI)

- 60% bonds (AGG)

- 20% bitcoin (BTC)

The returns over the last 5 years: 48% annualized with a lower maximum drawdown than the 80/20 stock/bond portfolio.

Devil's Advocate

A key takeaway for the Bitcoin Maximalists in the crowd is that these sorts of portfolios which include stocks and bonds will continue to appeal to investors for the reduction in volatility and smoothed-out – albeit lowered-total – return profile.

Finding a Middle Ground

Every individual has to decide for themselves how to allocate their capital. Whether on discretionary spending, savings or investment, you are the one in the driver's seat.

Personally, I go through these sorts of simulations and exercises a few times a year to see how I might improve my potential investment outcomes and update my game plan. I recommend you do the same.

Defining the outer bounds on our range of expectations is helpful, I think, in finding the middle ground.

On the one hand, you could be 'uber-safe' and allocate 50/50 to stocks and bonds. Over the last 5 years, your returns would be around 10% before inflation, with a maximum drawdown of about 10%. Very stable and predictable, all things considered. (Think about everything that has happened over the last 5 years!)

On the other hand, you could be 'FOMO BITCOIN ALL THE WAY' and allocate 100% into bitcoin. You would have had a compound annual growth rate of 107%, but with drawdowns up to 74% in a given year.

Anti-FOMO

The ideal Anti-FOMO portfolio is the one that allows you to meet your goals in a reasonable amount of time without going underwater (going into debt).

Debt and leverage are two of the most pernicious aspects of the FOMO mentality. Returns should not be chased with a credit card as an accelerant. Returns should be earned by meticulous planning, budgeting and regular fixed invesment over decades.

If you can stomach 75% drawdowns and maintain an adequate lifestyle for you and your family, by all means, dive into the Bitcoin Standard Lifestyle and #GetOnZero. You may, over time, realize 50-100% annualized returns, looking ahead.

If you require more predictable return streams, consider something in the middle. For example:

- 34% bitcoin

- 33% stocks

- 33% bonds

(^ 5-year CAGR: 69%; Max Drawdown: 26%)

If a Maximum Drawdown of over 20% is too much for you, go more conservative. For example:

- 75% bonds

- 25% bitcoin

(^ 5-year CAGR: 53%; Max Drawdown: 19%)

With this upgraded conservative portfolio featuring a one-quarter bitcoin allocation, let's project out. Assume the returns are half of what they have been over the last 5 years first, to be safe...

If your portfolio averages 25% annualized returns, the Jones couple we mentioned earlier could save 1% per year and end up with 14x more money, over $17,000,000 after 20 years.

Even with a portfolio averaging 20% per year, starting with 2 years' savings ($200,000), and contributing nothing more gets them to $7.6 million by the year 2042.

But what if you're not the Jones? What if you have $0 savings now? If you can save $5,000 per year and you earn 20% a year on your investments, in 20 years you should have around $930,000. Best get started then!

Live the Plan

It's one thing to simulate different scenarios and derive a plan. It's another to actually act on it.

Once you have a goal in mind, with a path to get there, start working on it right away. Don't wait.

Even if you can only invest 1% of your income every year, do it!

The longer you wait, the more you miss out on compounding of your wealth.

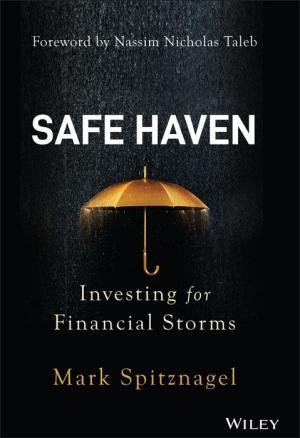

If you're still unsure about investing and risk management in general, I would recommend this book:

Safe Haven Investing: Investing for Financial Storms, by Mark Spitznagel

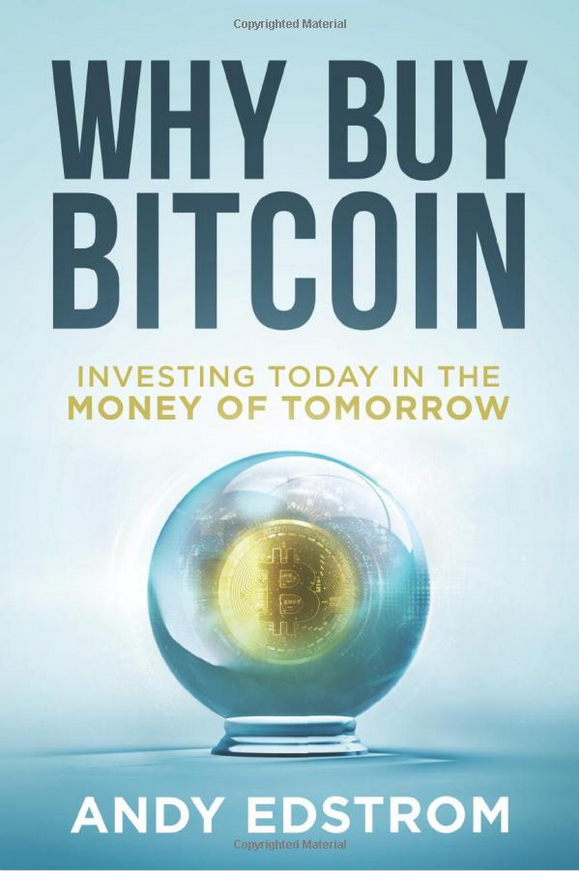

And if you're still unsure about investing in bitcoin, read Why Buy Bitcoin: Investing Today in the Money of Tomorrow, by Andy Edstrom:

Both books come to different conclusions, but together I think they can be used to inform a coherent investing and savings strategy.