Why Bitcoiners Should Invest in Real Estate

You own bitcoin. You believe in Individual Sovereignty. Your views are informed by Austrian Economics. Of all potential economic systems, you most admire those built on a foundation of Free Market Capitalism.

You could just own bitcoin. Sell your house, sell your chairs, buy more bitcoin. Right?

So what could you possibly be missing out on being 100% in bitcoin anyway?

For me, more than gold, stocks, bonds or any other asset: The one asset I think most aligns with and compliments bitcoin is Real Estate.

Why Real Estate?

Diversification, for one. Bitcoin volatility has not dropped significantly or consistently. Nor may it ever. It's inelastic supply is set in stone. And demand will reasonably fluctuate wildly into the future. Owning land or real estate can help to smooth out the wild swings in the individual bitcoiner's purchasing power, until such a time as a Bitcoin Standard is established worldwide.

Reasonable Returns. No form of Real Estate can compete with the "Store of Value" properties of Bitcoin from 2011-2023+... But nothing really does. Compared with M2, GDP, CPI and Gold, however, Real Estate stands up well. It tends to match or outpace the rate of the debasement of the fiat money supply, going back decades and decades. The value of a house or a plot of land tends to vary a lot less around the regression line of the fiat money supply, as well. In short, real estate has performed well historically with lower volatility than something like the stock market. (Certain "hot" markets being the exception to the rule.) – More on the Return Profiles later...

Sovereignty. Yes, Sovereignty. Bear with me now... We all fear the return of the "6102 Attack", as bitcoiners. We hardcore orange-pilled maximalists like to maintain custody of our coins ourselves. And for good reason. The US Government has seized its citizens' gold before (EO 6102), and used Eminent Domain countless times to take over property blocking the 'path of progress'. But farmland and housing are critical. This is broadly recognized in US law, and ownership and investment are strongly incentivized. Ownership for oneself, as in a Primary Home, provides more freedom than that granted by a landlord. And ownership of Investment Properties is given the best of tax treatment: Depreciation, Income Tax Breaks, Interest Payment Tax Breaks, Opportunity Zone Bonuses, and more. The Sovereign Investor case for Real Estate is bolstered by the Limited Liability Company (LLC) ownership wrapper as well, which increases landlord privacy and adds significant legal protections.

Economic Development. By developing, improving or maintaining good quality housing, commercial and industrial properties, the Sovereign Real Estate Investor contributes to a stronger economy, which benefits both the tenants and the owner himself. Having more Bitcoiners who invest in Real Estate, I would contend, will be a net-benefit to society and local communities. Providing value for value, one can also earn bitcoin, if one chooses to allow for rent payment in bitcoin. Just ask yourself: Would you rather rent from Blackrock or from a Bitcoiner in the year 2030?

In the year 2030, would you rather rent from Blackrock or from a Bitcoiner?

Flexibility. Real Estate Investors can live anywhere they choose, investing in the best pockets of the US market. They can trade up and take advantage of Like-Kind Exchanges, deferring Capital Gains taxes while increasing monthly cashflow and/or growth potential. Consider a bitcoiner who starts with a Single Family Rental, holds for 3-5 years, and then trades up to a Duplex or Fourplex. The equity remains, and no taxes are paid during this step-up in the process. Best of all, you can free yourself from a fiat W-2 job this way.

Some people put literally all their time and energy into Real Estate. Others, into Bitcoin. My question is: Why not a little of both?

Bitcoin provides the best capital appreciation potential, and allows you to make the payments you want to make, whenever you want to make them.

Real Estate can provide you with steady and increasing income, and huge tax breaks. Plus, you contribute to your community and the communities you invest in as a good landlord as you do this.

Protecting Yourself as a Real Estate Investor

Holding Real Estate through a Limited Liability Company (LLC) affords certain protections. It enhances your privacy by registering the ownership of the property under a pseudonymous company name and business mailing address/forwarding address. It allows you to keep your identity off the public record. And it limits your total liability in case you are sued for some reason, to the total value of the property itself. Typically, investors put one property into one LLC. They create a new LLC for each additional property. Thereby, they limit the blast radius of any one of them going under to the property in question, and any associated assets/cash balances, etc.

LLCs can also be modified to allow for new/different owners to buy in or sell out of portions of the property, if you wish to invest with other people.

Liability, Hazard and Home Insurance help cover the rest of the risk matrix, as much as possible. It's still possible you could lose an entire property and its value to something like a Terrorist Attack or other Act of God and not be covered by insurance. However unlikely these events may be it's worth mentioning it.

Return Profiles Matter

Most bitcoiners talking about Real Estate on Twitter/X seem to focus on the Store of Value vector, and I've even seen some compare public REIT indexes like 'VNQ' to bitcoin on a nominal basis to "prove BTC's superiority". Sure, you can make the comparison, but most actual Real Estate Investors do not just 'buy a Vanguard index fund'...

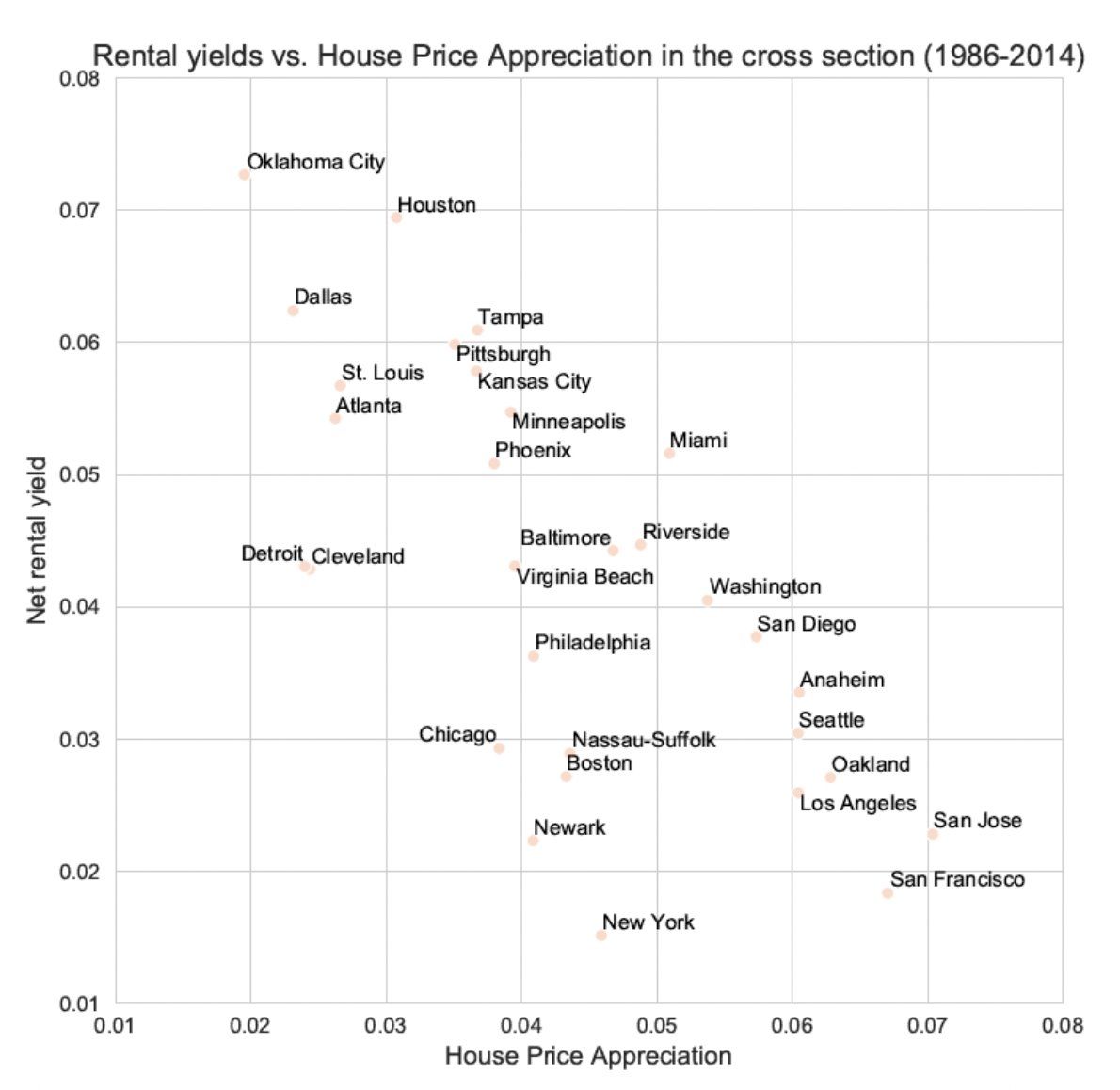

The fact is that Real Estate is a very broad umbrella, with wildly different return profiles. There are Single-Family Rentals, Fourplexes, Apartment Buildings, Self-Storage Facilities, Shopping Malls, even ATMs and Trailer Parks count. Some of these in "Hot" markets may return 5-10% in year in appreciation terms alone. Others, like a conservatively run Single-Family Rental in a linear market, may only earn 1-2% in appreciation, but net you 5-10% cash-on-cash return in terms of rental income each year.

It's also a HyperLocal Phenomenon. Austin and Phoenix don't compare very well with Indianapolis, IA and Peoria, IL. Even from neighborhood to neighborhood you can see wide disparities. It makes sense when you think about it for half a second, but all this is frequently glossed over in the Influencer TwitterSphere.

What excites me most when I think about Real Estate Returns is the idea that the tenant pays down your loan while fiat inflation debases it further. The concept, as coined by Jason Hartman, is "Inflation-Induced Debt Destruction". In addition to earning some income from the rent, the government printing more money actually helps you when you take on a modest amount of debt to buy investment properties, and then you get all the other aforementioned tax benefits. Over the years, as rents rise (ideally) in tandem with the local economy, your cash-on-cash return improves, while your debt is further eroded and paid down by your tenants.

The tenant pays down your loan for you while fiat inflation further debases its value over time.

Eventually, a more mature property that started with say a 25% downpayment at 8% rates and a cash-on-cash return of 5%, for example, can increase to something like 15% effective yield on your money. And you still get to take all the deductions on depreciation, and so on.

This pairs well with bitcoin, which receives much less favorable tax treatment. With fiat being debased, the tax + inflation penalty, assuming you pay your taxes on your bitcoin gains, increases further. If bitcoin goes from 50,000 to 100,000 but inflation is 25%, then you still owe a tax on the 25% of the "gain" that is captured as a result of the fiat debasement when you sell.

By contrast, when your property increases in value with inflation, normal appreciation, etc. and you decide to "trade-up" properties via Like-Kind Exchange, you pay $0 on the gains.

This 'end-game' of Real Estate is really remarkable, as is the dream of Global Bitcoin Adoption.

The fact is that one of these is a reality today, and the other we may have to wait at least a decade or more to see come to fruition.

In the meantime, I think it's a good alternative for a bitcoiner to consider. Nothing gets better tax treatment than Investment Property and you can Replace Your W-2 Income if you do things right.

Resources: Read On & Learn More

- Why the Rich Are Getting Richer, by Robert Kiyosaki

- The Book on Rental Property Investing, by Brandon Turner

- Trump Strategies for Real Estate, by George H. Ross

- One Rental at a Time, by Michael Zuber

- First-Time Landlord, by Janet Portman/Ilona Bray/Marcia Stewart

- The Complete Guide to Investing in Rental Property, by Steve Berges

- The Multifamily Millionaire (Volume I): Achieve Financial Freedom by Investing in Small Multifamily Real Estate, by Brandon Turner & Brian Murray